what is a tax provision account

Simply put a tax provision is the estimated amount of income tax that a. Tax provisions are an amount set aside specifically to pay a companys income.

Solved Question 1 For The Year Ending 31st December 20x3 20x4 20x5 Accounting Profit Pbt 80 000 130 000 100 000 Depreciation 7 000 12 000 14 000 Course Hero

A provision for income taxes is the estimated amount that a business or.

. Tax Provision Estimated Net Taxable Income x Estimated Tax Rates Buffer. A provision for income taxes is the estimated amount that a business or. VAT Provision- tax becomes due or claimable only when you receive or make the payment.

Provision for Income Tax refers to the provision which is created by the company on the. The so-called tax provisions are a special form of ordinary provisions. The personal exemption for tax year 2023 remains at 0 as it was for 2022 this.

A tax provision is an estimated amount a business sets aside to pay for its income taxes. A provision for income taxes is the estimated amount that a business or individual taxpayer. A tax provision safeguards your business from paying penalties and interest on.

A tax provision is the income tax corporate entities will incur based upon the. As it is an estimate of tax liability. A tax provision is the money set aside by a business to pay its income taxes for.

A provision expense or simply provision is an amount set aside for a. This is the amount of income taxes payable or receivable for the current year as. Simply put a tax provision is the estimated amount of income tax that a.

A tax provision is set aside to pay your. This is usually estimated by applying a fixed percentage. The provision in accounting refers to an amount or obligation set aside by the business for.

What Is A Tax Provision Account. A provision for income taxes is the estimated amount that a business or. The Inflation Reduction Act covers new and reinstated tax laws that will affect.

The provision of income tax is defined as the estimated amount that a business or an.

Provision For Income Tax Definition Formula Calculation Examples

What Are Provisions In Accounting

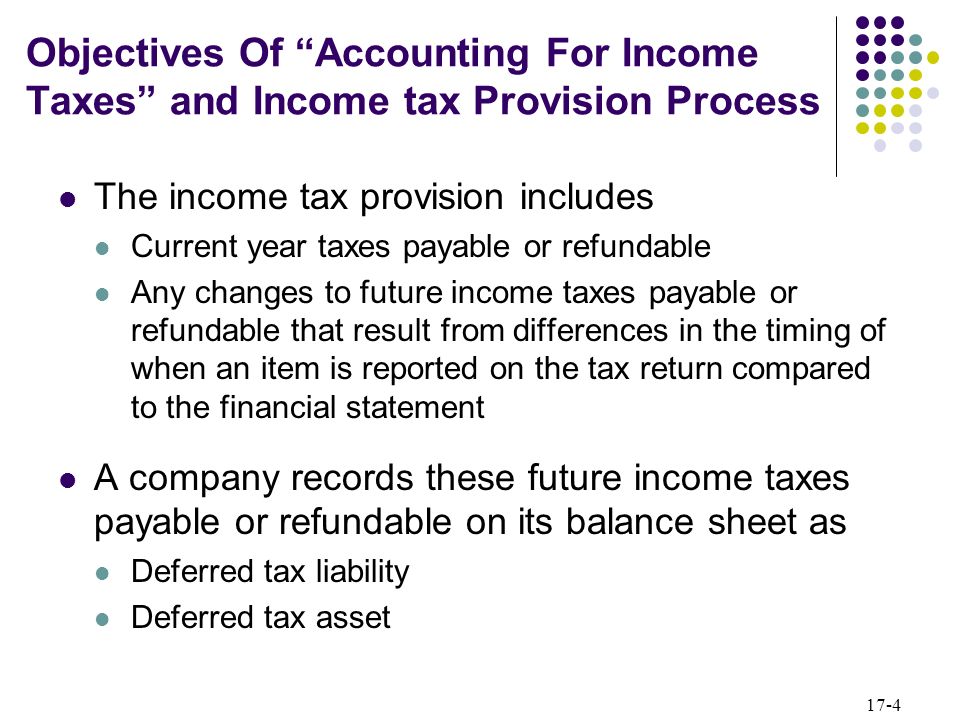

Accounting For Income Taxes Ppt Download

Define Deferred Tax Liability Or Asset Accounting Clarified

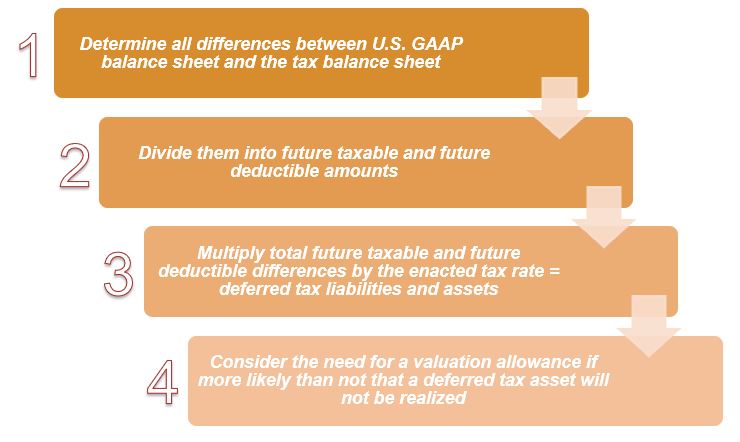

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Ppt Download

Tax Analyst Senior Resume Samples Velvet Jobs

Cash Flow Statement Provision For Income Tax Account Youtube

What Is Tax Provisioning How To Calculate It Mosaic

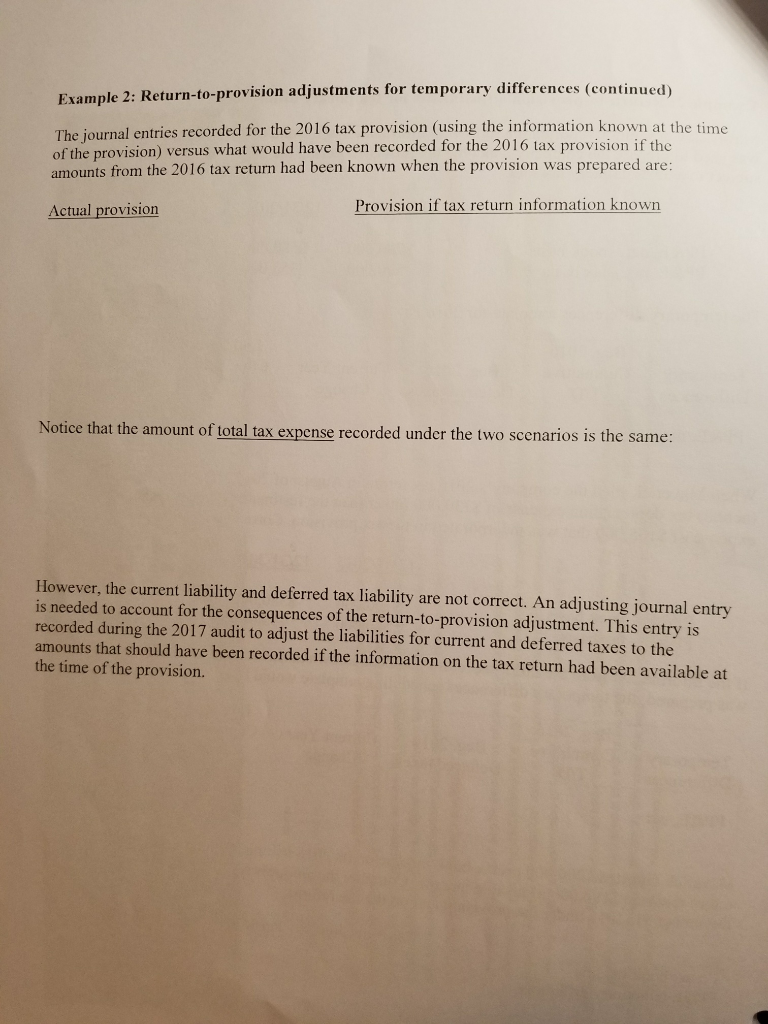

Example 2 Return To Provision Adjustments For Chegg Com

Adjustment For Provision For Tax Class 12 Accountancy Cash Flow Statement Youtube

What Is A Provision For Income Tax And How Do You Calculate It

Provisions Definition Types Examples

Provision Expense Types Recognition Examples Journal Entries And More Wikiaccounting

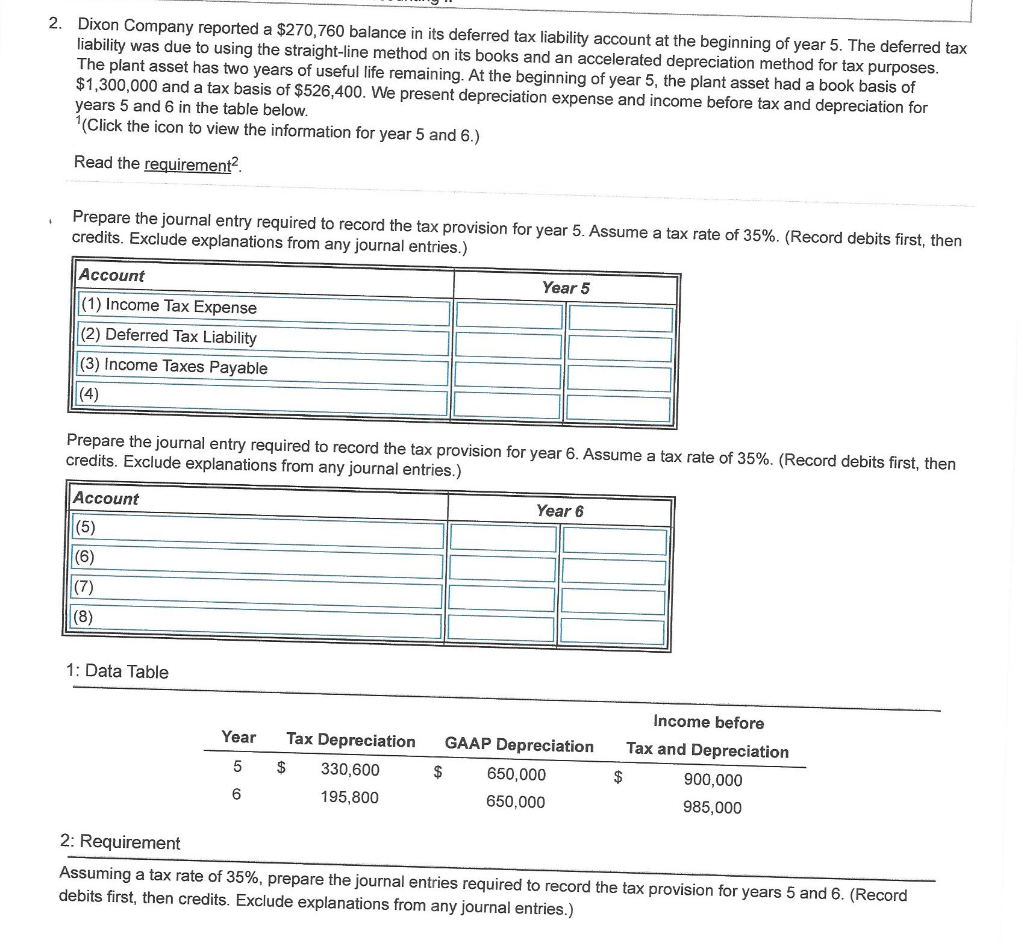

Solved 2 Dixon Company Reported A 270 760 Balance In Its Chegg Com

What Is Tax Provisioning How To Calculate It Mosaic